The fixed income tax rate for non-resident individuals be increased by 3 from 25 to 28 from YA 2016. Foreign Nationals Working In Malaysia - Tax Treaty Relief.

22 August 2016 Page 4 of 44 6.

. 112016 08122016 - Refer year 2016. Insurance relief and mortgage relief are also available for eligible persons. The government has added a lifestyle tax.

This relief is applicable for Year Assessment 2013 and 2015 only. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Definition of Related Companies and Eligibility for Group Relief For the purpose of group relief the meaning of related companies is provided in subsection 44A3 of the ITA.

It is that time of the year where you need to fulfil your duty as a Malaysian individual if you are earning income. Thats mean it is time for us to rummage through our house looking for the receipts. Tax relief for each child below 18 years of age is increased from RM1000 to RM2000 from year of assessment 2016.

Kenya Income Tax Rate for 2017-2018 2016-2017 2015-2016 2014. If planned properly you can save a significant amount of taxes. So do not miss out on any claim.

Finance Malaysia Blogspot 2016 Personal Income Tax Relief. Malaysia Personal Tax Relief 2021. Every individual who receives income is granted a tax credit or a tax relief from the Authority this is known as Personal Relief.

You can decide the tax saving for your personal tax granted by Lembaga Hasil Dalam Negeri LHDN. Resident companies with a paid up capital of myr 2 5 million and below as. 62016 Date Of Publication.

There are personal reliefs that every taxpayer in Malaysia can deduct once their income reaches the chargeable income level. The personal property tax relief act of 1998 pptra provides tax relief for vehicles locally registered within the commonwealth of virginia. The total tax credit is spread evenly during the charge year.

Previously this personal tax relief limit was capped at RM250. In the case of alimony. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of.

Tax relief for individual taxpayer whose spouse has no income is increased from RM3000 to RM4000. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. To provide relief for the private sector employees who contribute to the nations social security protection scheme the government has effectively increased the SOCSO tax relief limit.

As we know time is left until the Year 2022 is around 3 weeks and it is almost over. Contribute to syahrulputrimelayuzie development by creating an account on GitHub. Compensation For Loss Of Employment.

INLAND REVENUE BOARD OF MALAYSIA GROUP RELIEF FOR COMPANIES Public Ruling No. Additionally the scope of this tax benefit now includes employees contributions through the Employment Insurance System in. Superseded by the Public Ruling No.

The Gobear Complete Guide To Lhdn Income Tax Reliefs Gobear Malaysia. Personal reliefs for resident individuals types of relief ya 2016 rm self 9 000 disabled individual additional relief for self 6 000 spouse 4 000 disabled spouse additional spouse relief 3 500 child. E-filing with the Inland Revenue Board of Malaysia IRBM will only be available from March 1.

PERSONAL INCOME TAX 5 Types of relief YA 2016 RM Life insurance premiums and EPF contributions 6000 Private Retirement Scheme contributions and Deferred annuity scheme premium YA 2012 to YA 2021 3000 Insurance premiums for education or medical benefits 3000 Expenses on medical treatment special needs or carer. Perquisites from Employment Refer year. Remember to take full advantage of the tax reliefs available in filing your personal tax returns in 2022.

In addition there are other reliefs that you can deduct from your chargeable income if you had spent money in that category for the year. Personal Tax Relief for 2022. 2016 personal income tax relief figure.

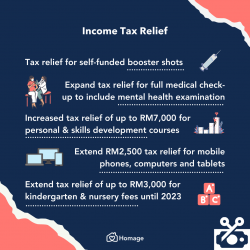

Govt Extends Tax Relief For Phones Computers Includes Covid 19 Tests For Medical Tax Relief

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Personal Tax Reliefs In Malaysia

Individual Income Tax In Malaysia For Expatriates

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

7 Tips To File Malaysian Income Tax For Beginners

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Malaysia Personal Income Tax Relief 2021

到底几时要报税 2017年income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

Malaysia Personal Income Tax Relief 2022